Making your mortgage application a whole lot smoother

Do you know how many steps it takes to get one of our customers from their initial enquiry to mortgage completion?

I wasn’t totally sure myself, until a month or so ago.

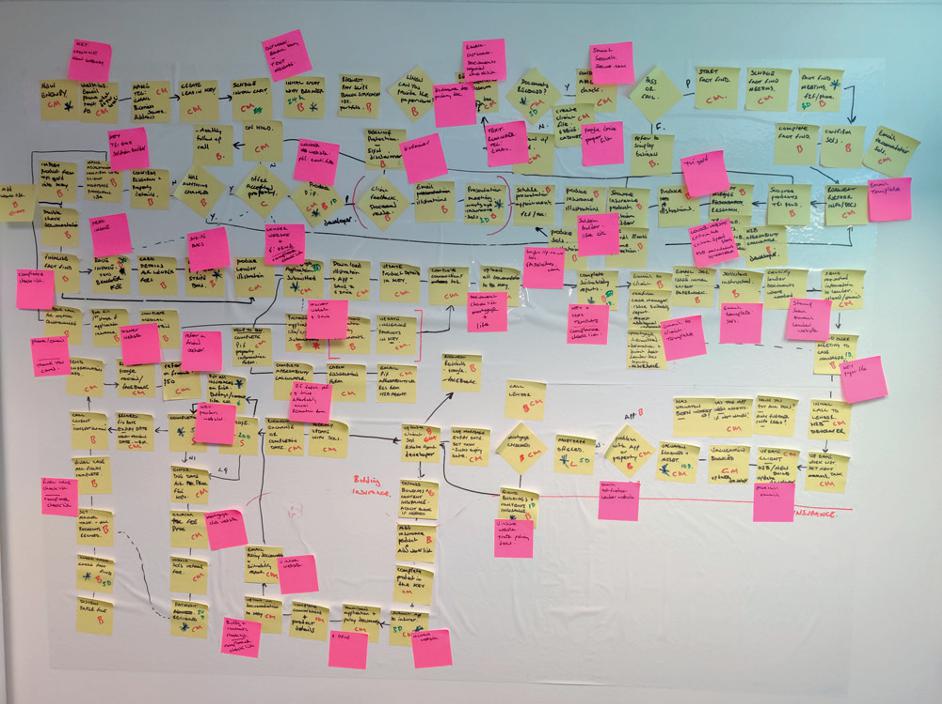

That was when we shut up shop for a couple of days and mapped out our customer journey to make every part of it as smooth and positive as possible.

The answer to my question? One hundred and twenty steps, no word of a lie.

And within those 120 steps are 20 important milestones that help mortgage applicants complete on their purchases and remortgages.

In most people’s minds, the process starts only when their application has actually been submitted to the lender. But for us? Everything kicks off a long time before that.

So the milestones cover everything from your very first contact with us and the “discovery chat” we’ll have (to look at mortgage feasibility), to fact finding, mortgage application, insurance matters and the completion of your purchase or remortgage.

With the actual application so far down the line at milestone eight, we’ll work quickly and tirelessly to make sure your paperwork is in order first, so we can get to the application and mortgage offer as quickly as possible.

That way we can get your application to the lender fast and help you feel like you’ve taken a significant step closer to mortgage or remortgage completion.

Now that you know how many different things need to fall into place to make a mortgage happen, you can probably imagine how tricky it is to pick up a colleague’s caseload if needs be.

But that’s just another reason we put our processes through this analysis.

We wanted to be able to pick up any client’s file and say, “Right, you’re at step 19, which means I need this from the lender and this from the client.”

It won’t just make life easier in the office. It’ll mean that you experience an even smoother journey with Three Sixty Mortgages too.

Because there really is rather a lot to it. You just have to glance at the wall in our office to realise that – that’s where the 120 post-it notes listing every part of the process are still sitting right now.

We’re keeping them there for now, as a reminder of the effort required to get our clients from their first point of contact to a happy, healthy mortgage.

And it’s not until a third of the way through the process at milestone seven that we actually take any payment.

See, we’re happy to commit a lot of time and hard work before we receive a penny because we know just how good our service is, and trust that clients will too.